Understanding Medicare enrollment periods is essential if you want to avoid penalties, missed opportunities, or gaps in your coverage. While some enrollment windows occur automatically based on age or life events, others happen each year and require careful timing.

Here, we’ll explain the different types of Medicare enrollment periods—what they are, who they apply to, and how to know which one you’re in.

Whether you’re approaching 65, reviewing your plan, or navigating a life change, we’re here to help you take the right step at the right time.

Start with Our Video Course

If you’re just starting your Medicare journey, our free video course is a great first step. It’s designed for people who want to understand:

The course is completely free, easy to follow, and gives you the clarity you need to move forward.

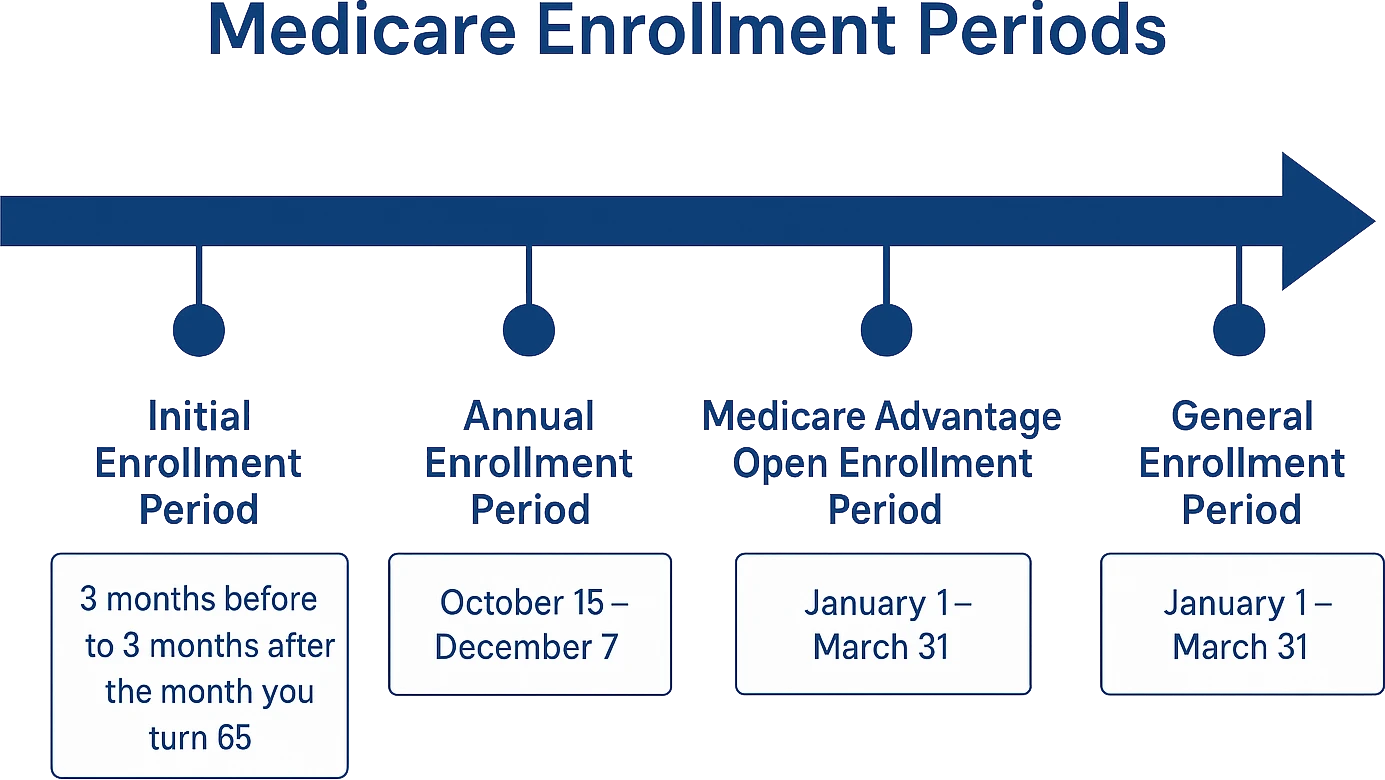

Most people will first enroll in Medicare during their Initial Enrollment Period, which surrounds their 65th birthday. This seven-month window begins three months before the month you turn 65, includes your birthday month, and ends three months after.

If you’re already receiving Social Security benefits, you may be enrolled automatically. If not, you’ll need to sign up through the Social Security Administration.

Enrolling during your IEP ensures timely coverage and helps you avoid permanent late enrollment penalties—especially for Medicare Part B and Part D.

During this window, you can:

It’s an important time to understand your coverage needs and explore your plan options.

The Time to Review and Make Changes: October 15th thru December 7th

Each fall, Medicare provides an opportunity to review your coverage and make changes for the following year. The Annual Enrollment Period applies whether you’re enrolled in Original Medicare or Medicare Advantage.

It’s the right time to:

Any changes made during AEP take effect on January 1 of the new year. Even if you’re happy with your current plan, it’s worth reviewing your options, plans, and drug formularies can change from year to year.

A Second Chance for Medicare Advantage Members

From January 1 to March 31, individuals who are already enrolled in a Medicare Advantage plan have an opportunity to make a one-time change. This period is specifically for people already in a Medicare Advantage plan as of January 1.

You can:

However, you can’t join a Medicare Advantage plan for the first time during this period, it’s intended for those re-evaluating their current selection.

Coverage Options After Life Changes

Not all Medicare decisions happen on a predictable schedule. Certain qualifying events may open a Special Enrollment Period, giving you the opportunity to enroll or change plans outside of the standard timeframes.

Life events that may trigger an SEP include:

Each SEP has its own rules and timelines. If you’re unsure whether you qualify, we can help assess your eligibility and guide you through your options.

If You Missed Your Initial Enrollment Period

If you didn’t enroll in Medicare when you were first eligible and you don’t qualify for a Special Enrollment Period, you can still sign up during the General Enrollment Period, which runs from January 1st to March 31st each year.

Coverage begins the month after you enroll, and you may face late penalties for Medicare Part B and Part D. While not ideal, this period is a second chance to secure coverage and avoid further delays.

Understanding when and how to enroll in Medicare is just as important as choosing the right plan. Whether you’re preparing for your 65th birthday, reviewing your options during AEP, or navigating a life change, we’ll walk you through every step.

Our licensed advisors are here to answer your questions, explain your timeline, and help you avoid unnecessary penalties or delays, all at no cost to you.